Once you’re fully approved to work with Landis, you’ll receive a personalized homebuying budget for your next step of finding, touring, and making offers on homes.

It’s important to stick to your budget as you navigate all the listings, social media, and for sale signs you come across in your home search. It helps your agent understand what you can afford on the market and which houses are best to show you.

You may wonder how our team came up with this number. Let’s dive into how your budget is created, what it’s based on, and how it helps you become a homeowner.

A tool for the present and future

The Landis underwriting team sets your budget to best ensure that you’ll be able to get a mortgage at the end of our program. It’s not a one-size-fits-all number — your budget takes into account your finances, the market environment, and your goals for the next 1–2 years as you work with a Landis coach.

You can also request a budget in your application, if, for example, you’ve got a specific house in mind that you want to be approved for.

What goes into calculating your budget

Your budget is based on the information you’ve provided in your application, including these four pieces that our team considers.

#1 Debt-to-income ratio

Your debt-to-income ratio, also referred to as DTI, is a percentage representing the portion of your gross monthly income (before taxes) that goes toward paying off debts. Learn about your debt-to-income ratio here.

#2 Savings

Landis helps you build up your savings so you can qualify for a mortgage. But to get there, we ask for a commitment from our clients in the form of an initial down payment deposit that’s 2–3% of your home’s price. This goes directly towards the down payment and closing costs when you buy the home from Landis.

You’ll also be building your savings month-by-month alongside your rent, so the more you put down upfront, the less you need to pay into your down payment savings each month.

#3 Preferred monthly payment

You probably already know how much you can afford to pay for your home each month. We factor that number into your budget to make sure it aligns fairly with your monthly rent and your future mortgage payment as a homeowner.

#4 Your geographic area

Landis has minimum requirements for household incomes, home prices, and monthly payments that vary based on the region you’re looking to live in. One of our team members will be able to explain what you need for your specific area as soon as you fill out an application.

The best part of your budget? Flexibility.

Landis isn’t a lender, which means we have the freedom to help more clients move into their dream home sooner rather than waiting until they meet every mortgage requirement.

If you need to raise your credit score (of at least 550), or you have some gaps in your employment history, or limited savings, that’s okay. Our coaches provide personalized advice and a step-by-step action plan to help you own your home by the end of your rental period.

If you’re not happy with the initial budget you’re given, you can always talk to the Landis team about how to qualify for an increased amount.

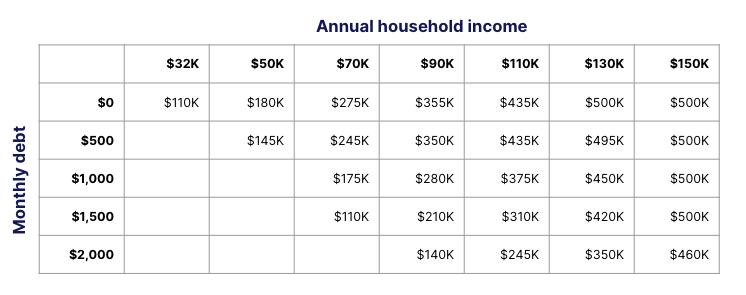

Estimate your budget using our matrix